Best Insurance Options for Small Engine Parts Manufacturing Units

Insurance Options Every Small Engine Parts Manufacturer Should Consider

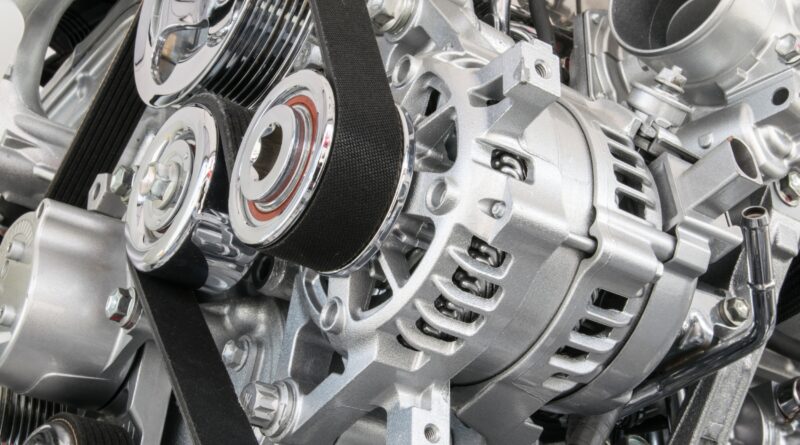

Starting a small engine parts manufacturing unit? That’s a big step—and it comes with risks. One unexpected fire, accident, or machinery breakdown could put a dent in your business and your finances. That’s where the right insurance comes into play.

Choosing the right insurance plan is not just about checking a box. It’s about protecting your time, investment, and future. From property protection to liabilities, let’s break down the insurance options that make the most sense for your new venture.

Why Insurance Matters for Small Manufacturers

Running a small manufacturing unit, especially in the automotive or machinery space, means dealing with expensive equipment, raw materials, and delivery timelines. Any disruption—from fire damage to a third-party injury—can slow or even stop operations.

Ask yourself this:

What would happen if a machine caught fire or an employee got injured on the job?

Don’t wait to find out. Insuring your business ensures you’re prepared.

Types of Insurance You Should Consider

Every manufacturing unit is different, and so are its risks. But for a small engine parts manufacturer, a few types of insurance are particularly important.

1. Standard Fire and Special Perils Policy

This is your base layer of protection. It covers physical assets such as:

- Buildings (if you own or rent one)

- Machinery and equipment

- Stock and raw materials

- Furniture and fixtures

It protects your property from loss or damage due to risks like:

- Fire

- Storms or cyclones

- Flooding

- Theft or burglary

This policy is usually the foundation upon which you add other insurance coverage.

2. Burglary and Theft Insurance

Even with strong locks and CCTV, theft can happen. This insurance protects:

- Valuable raw materials

- Finished goods stored in your unit

- Machinery parts that are easy targets for thieves

It’s a helpful add-on to your fire insurance, especially if your unit operates in an area with higher crime rates.

3. Machinery Breakdown Insurance

Your machines are your business. If they stop, so do your operations.

This coverage kicks in if there’s:

- A mechanical failure

- An electrical short circuit

- Wear and tear that leads to sudden equipment failure

It doesn’t cover routine maintenance, but it can help you recover from sudden, unexpected breakdowns. That can save you thousands in repair and lost production.

4. Workmen’s Compensation Insurance

Manufacturing jobs carry risks. Someone could slip, fall, or get caught in machinery.

Workmen’s compensation insurance ensures that if a worker gets injured on the job, you won’t face heavy financial or legal consequences. It helps cover:

- Medical expenses

- Lost wages

- Death or disability compensation

It’s also legally mandatory in many states, so there’s no skipping it.

5. Public Liability Insurance

If a visitor or vendor gets injured on your premises or suffers damage related to your business operations, this policy covers your liability.

Imagine a situation where a delivery agent slips on an oil spill in your unit and gets injured. You could be held responsible. This insurance protects you from picking up the entire medical bill or facing a lawsuit yourself.

6. Product Liability Insurance

Let’s say your engine part malfunctions and causes damage to a customer’s vehicle. You could be sued or asked to compensate for losses.

This policy protects you from claims related to:

- Defective products

- Design or manufacturing flaws

- Improper labeling or instructions

Even if you take quality seriously, errors can happen. This coverage gives peace of mind.

7. Marine Cargo Insurance (for Incoming and Outgoing Goods)

Do you import parts or export finished goods? Consider protecting your shipments with marine cargo insurance.

It covers:

- Loss or damage during transport

- Accidents while loading or unloading

- Natural disasters during transit

Think road accidents, warehouse fires, or damaged packaging. This is especially handy for units that depend on a supply chain.

Putting Together Your Insurance Package

So, how do you make sense of all this? You don’t always need every single policy, but you should layer your coverage according to your business size, risks, and budget.

Here’s a simplified way to approach it:

- Start with fire and burglary insurance as your base coverage.

- Add machinery breakdown to keep your operations moving.

- Include workmen’s compensation if you have employees.

- Consider public and product liability based on what you produce and who visits your site.

- Add marine insurance if you often transport goods.

What Factors Influence Your Insurance Premium?

Several things can affect how much you’ll pay for insurance. Knowing them can help you plan better.

- The size and location of your manufacturing unit

- The number of employees and the type of work they do

- Value of your assets—buildings, machines, inventory

- Claims history, if any

- Safety measures you have in place like CCTV, fire extinguishers, and training

How to Choose the Right Insurance Provider

Every company has its strengths. When comparing policies, look beyond just the premium.

Ask yourself:

- Does the provider understand manufacturing businesses?

- How quickly do they process claims?

- Are there hidden conditions or exclusions?

Use a licensed insurance advisor. They’ll help customize a package that fits both your business needs and budget.

Final Thoughts

Insurance for small engine parts manufacturing units isn’t just a safety net. It’s a tool that protects growth, supports operations, and builds trust—with employees, clients, and suppliers.

Don’t view it as an added expense. Think of it as a long-term investment in your business stability.

Start by reviewing your setup. Look at what you own, what could go wrong, and who might be at risk. Then, talk to an expert. The more tailored your insurance plan, the smoother your business journey will be.

After all, you’ve put time, money, and energy into building something. It’s only smart to protect it the right way.